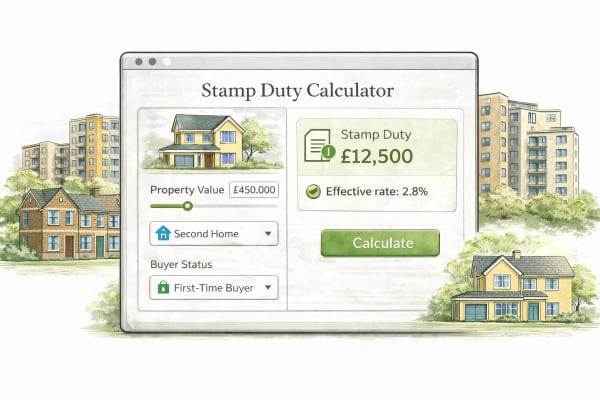

Stamp Duty & Land Taxes Calculator

Calculate SDLT (England & NI), LBTT (Scotland) and LTT (Wales), including first‑time buyer rules, second home / higher rates and SDLT non‑resident surcharge.

Inputs

Results

Enter details on the left and hit Calculate to see the breakdown.

Notes

- England & NI: SDLT higher rates add +5% to the full price; non‑resident adds +2% (both cumulative).

- Scotland: LBTT ADS is 8% on the full price; FTB nil‑rate band increased to £175,000.

- Wales: LTT has separate higher‑rates bands for additional properties; no FTB relief.

- This tool is a guide only and does not constitute advice.